Posted on: August 1, 2025

Understanding Spending Habits & Your Mortgage Application

Before you apply for a mortgage, it’s essential to understand how lenders view your financial behaviour. This article explores how everyday spending habits and your credit file impact your mortgage application, highlighting what underwriters look for and how you can improve your financial profile. From building disciplined payment routines to optimising your credit score, these insights could make all the difference when it comes to securing the best possible deal.

Understanding Spending Habits

Your spending habits reveal whether you live within your means and can afford monthly mortgage payments. Key patterns lenders examine include:

- Consistent on-time bill and loan repayments

- Low levels of credit utilisation (how much of your available credit you use)

- Regular income-to-expenditure balance without frequent overdraft usage

- Evidence of savings or emergency fund accumulation

Overspending, maximising credit cards month after month, or relying on overdrafts signals to lenders that you may struggle with the fixed cost of a mortgage. Building disciplined habits—such as budgeting apps, setting saving goals, and automating bill payments—can improve your profile before you apply.

The Role of Your Credit File

Your credit file (or credit report) is a detailed record maintained by credit reference agencies. It compiles:

- Personal identification and address history

- Details of existing credit accounts (credit cards, loans, overdrafts)

- Account opening dates and current balances

- Payment history, including late or missed payments

- County court judgments (CCJs), defaults, and bankruptcies

A clean credit file shows you pay on time and manage multiple accounts responsibly. Conversely, missed payments, defaulted accounts, or a recent CCJ remain on file for up to six years, significantly reducing your chances of mortgage approval.

How Lenders Assess Your Application

Mortgage underwriters evaluate applications through a combination of affordability checks and credit scoring:

- Affordability Assessment

- Income verification (payslips, tax returns)

- Outgoings review (existing loan payments, living costs)

- Stress tests interest rate increases

- Credit Score Analysis

- Scores typically range from 300 to 850; higher is better

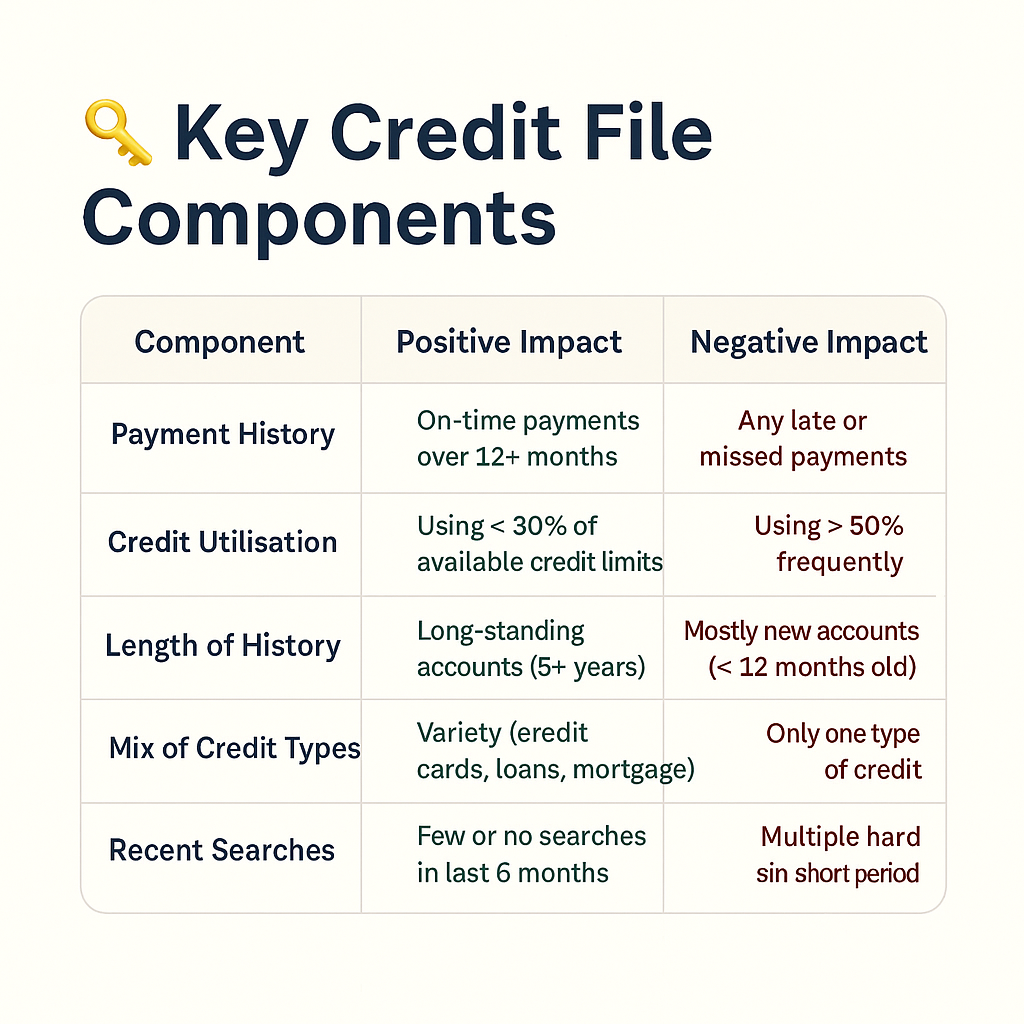

- Score factors: payment history, credit utilisation, length of credit history, account mix, and recent credit searches

- Risk Grading

- Applicants with strong scores and low debt can help to access better rates and higher loan-to-value ratios

- Those with borderline credit may need to apply to lenders with higher rates, additional fees, or even declined applications.

Tips to Improve Spending Habits and Credit File

- Automate bills and direct debits to avoid missed payments.

- Aim to pay credit card balances in full each month.

- Keep utilisation below 30% of your total credit limits.

- Avoid opening multiple new credit accounts close together.

- Review your credit report annually and correct any errors.

- Build an emergency fund to cover unexpected costs instead of relying on overdrafts.

Try not to use pay day loans.

Keep any gambling transactions to a minimum

Conclusion

Strong, responsible spending habits and a healthy credit file work hand in hand to unlock the best mortgage deals. By tracking your budgets, making repayments on time, and maintaining a low credit utilisation rate, you demonstrate financial stability to lenders. Regularly checking and improving your credit file gives you control over your mortgage prospects.

We hope this article helps you understand how your spending and credit score affect your mortgage acceptance. If you have any more questions or need further assistance, feel free to get in touch.

Craig Power craig.power@villagefs.co.uk or Luke.spires@villagefs.co.uk.

the information contained within was correct at the time of publication but is subject to change. 01.08.2025

Your home may be repossessed if you do not keep up repayments on your mortgage